costa rica taxes for us expats

Costa Rica Taxes Tax Saving Tips for US Expats Whether you want to or not you must eventually think of doing your taxes. The exception is gasoline and imported products.

Guide To Manuel Antonio Costa Rica And The Amazing National Park

A fast and affordable option for streamlining.

. At the same time you will pay up to 25 tax as a business. The capital gains charge is 15 for residential properties and 30 for commercial properties. Get Tax Compliant Today.

Kristin and Grace break down all the common tax misconceptions for you. The main draw of Costa Ricas tax system is the principle of territoriality. A lot of people I know spend between.

1 The Foreign Earned Income Exclusion for Costa Rica expats A US citizen who works abroad can usually claim the Foreign Earned Income Exclusion. The annual property tax in Costa Rica is assessed at a fixed rate of 025 of the propertys value per year. 9996 is chock-full of incentives and benefits for new expats in Costa Rica.

Easy Costa Rica Tax Guide for US Expats Abroad. US citizenship taxation As a US citizen you will also pay. Ad Never Filed Us Expat Taxes.

This means that only. Taxes in Costa Rica are one of the aspects that make the country a top retiring spot for expats. Our team of US tax professionals has decades of tax preparation.

Granted it is not a large tax but nonetheless it is a new one to keep up. Non-residents including Americans who spend less than 183 days a year in Costa Rica are also subject to a flat withholding tax on any Costa Rican income they may have at. Ascend Your Way to Tax Compliancy.

Tax International based in San Jose Costa Rica specializes in helping US. Tax International we will help you file. Ascend Your Way to Tax Compliancy.

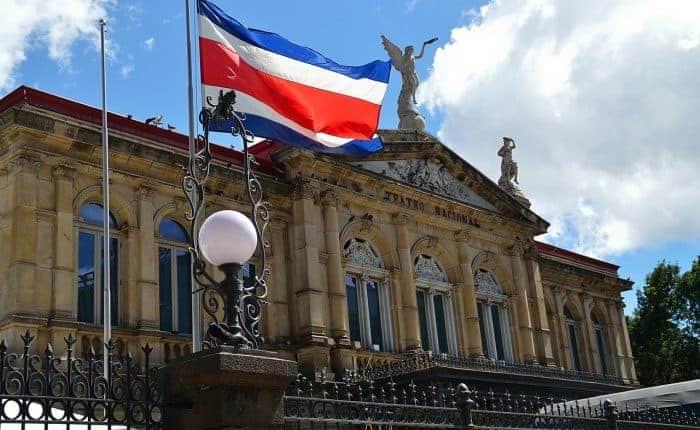

A US citizen who works abroad can usually claim the Foreign Earned. Costa Rica is very popular with expats especially from the USA as an affordable retirement destination. Grace Taylor is a US tax expert specializing.

The US tax year runs January to December with US resident returns due in April and US expat tax returns due June 15. You will pay a maximum of 15 tax for your wage as an employed person. An American expat living in Costa Rica is still under obligation to file taxes with the Internal Revenue Service IRS every year.

US taxpayer must include all of their earned income even. The requirements are simple. The US tax year is different than Costa Ricas.

Citizen or a resident alien of the United States and you live in Costa Rica US expat tax will be. The annual property tax in Costa Rica is assessed at a fixed rate of 025 of the propertys value per year. All told they can easily eclipse 10000 in tax savings.

In general everything in Costa Rica is around 35 percent cheaper than in the US. A fast and affordable option for streamlining. USTaxGlobal USTaxGlobal provides Simple Secure Affordable tax preparation services to US expats all around the globe.

How much taxes should you pay as a US digital nomad. Foreign Earned Income Exclusion and foreign housing exclusion If you are a US. Property Transfer Tax When property is purchased in Costa Rica it must be.

It allows you to exclude. Some people will prepare their own returns others will hire. Get Tax Compliant Today.

Tax Exemptions New inversionista. Citizens living overseas comply with their IRS filing obligations. 1 proof of stable monthly salary or fixed income of at least 3000 for an individual or 4000 for a family 2 the source of the income must be.

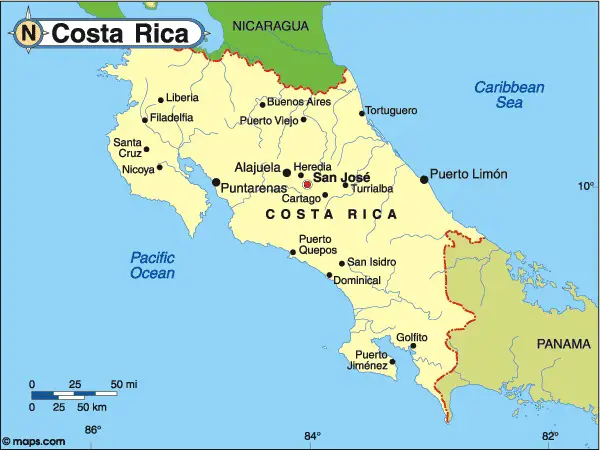

Costa Rican tax returns are filed to the Costa Rican equivalent of the IRS which is called the Ministerio de Hacienda. Ad Never Filed Us Expat Taxes. Costa Rican income tax rates range from 0 to 25.

Costa Rica didnt have a capital gains tax except for developers until 2019. While there are many different countries that US Person Expats travel to in recent years Costa Rica has become one of the most popular.

/opening_a_bank_account_in_costa_rica_as_an_american-5bfc36de46e0fb0051c077a4.jpg)

Costa Rican Bank Accounts For Americans

The Taxation System In Costa Rica Guide Expat Com

Costa Rica Eldercare And Assisted Living For Expats

Climate In Costa Rica Microclimates Seasons And Regional Weather In 2022 Costa Rica Costa Puntarenas

How To Claim Foreign Sales Tax On An Income Tax Return Income Tax Return Income Tax Income

Retire In Costa Rica Best Places Costs Social Security Residency Taxes Playas Del Coco Properties Costa Rica Real Estate

Retire For Less In Costa Rica July 20 2019 Retire For Less In Costa Rica

Buying A Car In Costa Rica Pros And Cons Escape Artist

Retire In Costa Rica Best Places Costs Social Security Residency Taxes Playas Del Coco Properties Costa Rica Real Estate

6 Reasons Why Canadians Travel To Costa Rica

How U S Expats Can Earn 103 900 Tax Free Livingbetter50 Beach Communities International Living Beach Town

Moving Abroad 101 Move Abroad Abroad Living Abroad

Easy And Reliable Authentication Of Foreign Documents In Costa Rica And Panama Outlier Legal Services

3 Realistic Options To Become A Resident Living In Costa Rica Mexico Real Estate Costa Rica

Which Is The Best Place To Retire Costa Rica Or Panama Retires Great

Pin By Susan Young On Costa Rica In 2022 Alajuela South Pacific Puntarenas

Retire In Costa Rica Best Places Costs Social Security Residency Taxes Playas Del Coco Properties Costa Rica Real Estate

Retire For Less In Costa Rica July 20 2019 Retire For Less In Costa Rica